As we stand on the brink of a new era, the integration of robot workers into the workforce is no longer a figment of our imagination. This technological revolution is transforming the landscape of business and financial operations, leading to the evolution of job titles and roles.

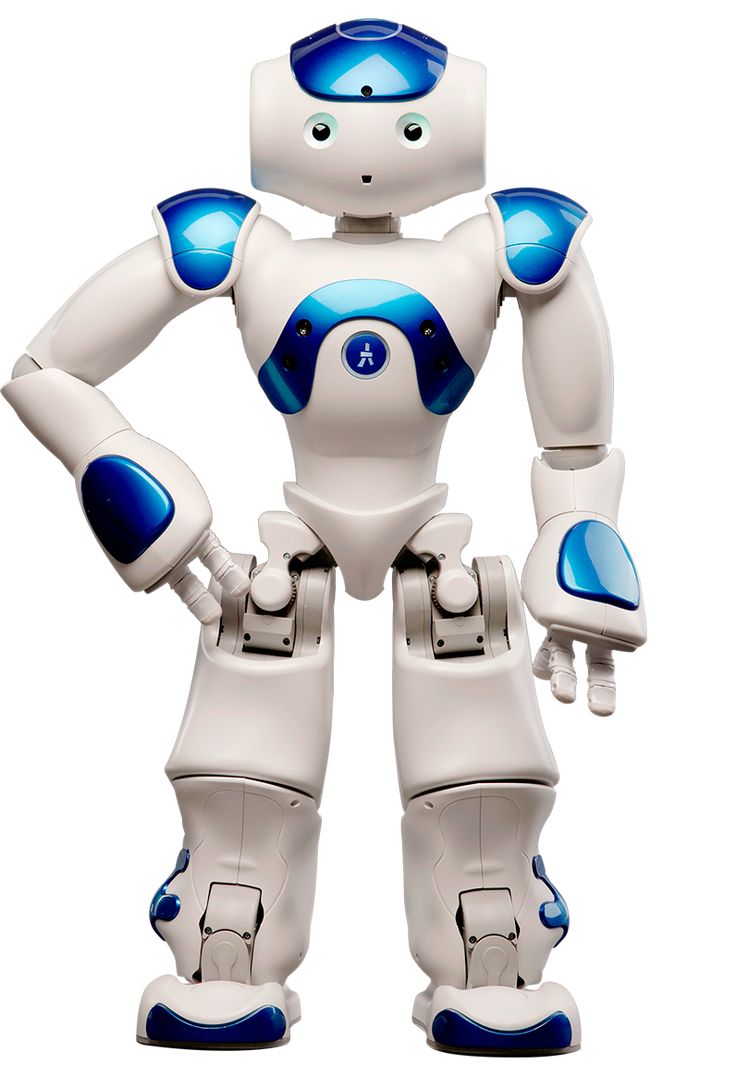

The rise of robot workers is not about replacing human jobs but rather about redefining them. The integration of automation and artificial intelligence is creating new opportunities and reshaping traditional roles in various sectors. Here's a look at how robot workers are impacting job titles in the realm of business and financial operations.

- Robo - Accountant and Auditor: With robot workers taking over repetitive tasks such as data entry and number crunching, accountants and auditors are now free to focus on strategic planning, risk management, and advisory services.

- Agent and Business Manager (Artists, Performers, and Athletes): Robot workers can handle scheduling, contract negotiations, and even financial management, allowing agents to concentrate on talent scouting, career development, and brand building.

- Budget Analyst: While robot workers can efficiently manage data collection and basic analysis, human budget analysts will be needed for strategic decision-making and forecasting.

- Business Operations Specialist: Robot workers can streamline processes and improve efficiency, but the human touch is still crucial for strategic planning, innovation, and relationship building.

- Buyers and Purchasing Agent: With robot workers handling inventory management and basic negotiations, buyers and purchasing agents can focus on supplier relationship management and strategic sourcing.

- Claims Adjusters, Appraisers, Examiners, and Investigators: Robot workers can expedite the claims process, but human adjusters are still needed for complex claims, fraud detection, and customer service.

- Compliance Officer: Robot workers can monitor transactions and flag potential violations, but human officers are essential for interpreting regulations, making judgments, and managing risk.

- Cost Estimator: While robot workers can crunch numbers, human estimators are needed for strategic planning, risk assessment, and decision-making.

- Credit Analyst and Counselor: Robot workers can automate data collection and basic analysis, but human analysts are crucial for risk assessment, decision-making, and customer service.

- Financial Analyst and Advisor: Robot workers can handle data analysis and basic forecasting, but human analysts are needed for strategic planning, risk management, and client relationship management.

The rise of robot workers is not a threat but an opportunity for professionals in business and financial operations. By taking over routine tasks, robot workers allow humans to focus on strategic planning, decision-making, innovation, and relationship building. As we embrace this new era, it's clear that the future of work is not about humans versus robots, but humans and robots working together.